Ron and Jane Graham’s commitment to funding scholarship, advancing athletics, transforming education and enhancing spaces for students at USask is truly inspiring and has earned them the distinction of being recognized as the most generous alumni donors in the university’s history.

Join Ron and Jane in supporting the Be What the World Needs campaign today.

JOIN US IN THE MOST AMBITIOUS CAMPAIGN IN SASKATCHEWAN'S HISTORY.

With you by our side, we can unlock the knowledge and skills needed so the world can look to USask for future discoveries, solutions, ideas, and the people who will make the world a better place.

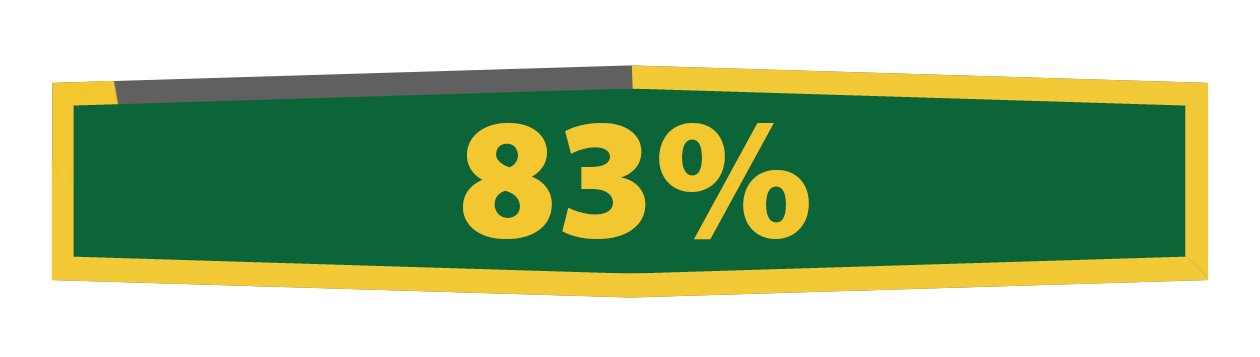

As of Dec. 2023, we've reached 77% of our goal. Thank you to our donors.

Together, we will Be What the World Needs.

PRIORITY AREAS

With your support, the University of Saskatchewan will:

PRIORITY

Lead Critical Research

Confront humanity's greatest challenges and opportunities through research and engage with communities to find solutions.

PRIORITY

Support Indigenous Achievement

Work with, and for, Indigenous communities to enact our firm commitment to mutual learning, lndigenization and reconciliation.

PRIORITY

Inspire Students to Succeed

Respond to current student need and attract future learners.

PRIORITY

Design Visionary Spaces

Create gathering places for people to collectively address the challenges of the future.

TOGETHER, LET'S CREATE A BRIGHTER FUTURE

USask is one of Canada's top research universities, with global strengths in food and water security and infectious diseases. Together, we will continue to work with Indigenous people and communities to embrace reconciliation. Our university has been at the centre of innovation, arts and culture, and commerce in Saskatchewan for more than 100 years.

Thanks to the support of alumni, donors and community members like you, we have never been better equipped to tackle global issues. Our vision is clear; our commitment is strong. Together, we can achieve our vision to be the university the world needs by investing in our ambitious people, projects and places. With you, the world can look to USask for future discoveries, solutions, ideas, and the people who will make the world a better place.

USask aspires to be the university the world needs.

Because the world needs...

EXPLORERS

THANKS TO OUR CHAMPIONS

Together, we are addressing the world’s greatest challenges. Thank you for supporting the biggest campaign in Saskatchewan’s history!